Background

The Goods and Services Tax (Jersey) Law 2007 makes it the responsibility of the Comptroller of Taxes to administer Goods and Services Tax (GST).

Article 36A was introduced into the Goods and Services Tax (Jersey) Law 2007 by Goods and Services Tax (Amendment No 4) (Jersey) Law 201- (adopted by the States on 5th December 2012 and given effect by acte opératoire) with effect from 1st January 2013.

This General Direction sets out the provisions for the purposes of Article 36A (3) which determine the circumstances and means by which GST registered businesses are required to adjust input tax claims if payment has not been made for a supply within specified time periods. The direction also deals with the restoration of entitlement to credit and the rules concerning the attribution of payment for supplies.

Paragraphs 4 and 5 are also applicable to adjustments to be made by suppliers under Article 54 and should be read in conjunction with the requirements of Direction 2008/24 issued in August 2008.

Legal basis: Direction under Articles 36A and 54 of the Goods and Services Tax (Jersey) Law 2007

Meaning of relevant period

For the purposes of this direction, the relevant period is the period of 6 months following the relevant date, as defined in Article 36A (2) of the Law.

Obligation to make GST accounting entry for repayment of input tax under Article 36A

(1) A person who:

- has not paid the whole or any part of the consideration for a supply by the end of the relevant period; and

- has claimed deduction of the whole or part of the GST on the supply as input tax (“the deduction”),

must make an entry in his or her GST account in accordance with sub-paragraph (2).

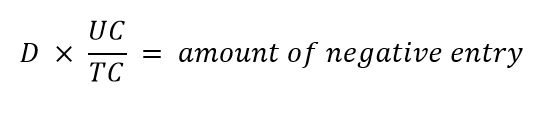

(2) The person must make a negative entry in the GST allowable portion of that part of the person’s GST account which relates to the person’s prescribed accounting period in which the end of the relevant period falls. The amount of the negative entry must be calculated as follows:

Where:

- D is the amount of the deduction

- UC is the amount of the consideration for the supply which has not been paid before the end of the relevant period

- TC is the total consideration for the supply.

(3) This paragraph does not apply where the supply is accounted for in accordance with the GST Cash Accounting Scheme specified in GST Direction 2010/02.

Restoration of entitlement to credit for input tax under Article 36A

(1) A person who:

- has made an entry in his or her GST account in accordance with paragraph 2 above (“the input tax repayment”);

- has made the return for the prescribed accounting period concerned and has paid any GST payable by the person in respect of that period; and

- after the end of the relevant period, has paid the whole or part of the consideration for the supply in relation to which the input tax repayment was made, must make an entry in his or her GST account, in accordance with sub-paragraph (2), in respect of each such payment made.

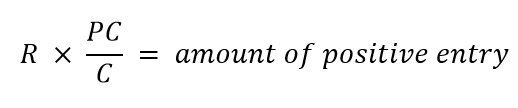

(2) The person must make a positive entry in the GST allowable portion of that part of the person’s GST account which relates to the person’s prescribed accounting period in which payment of the whole or part of the consideration was made. The amount of the positive entry must be calculated as follows:

Where:

- R is the input tax repayment

- PC is the amount of the payment referred to in sub-paragraph (1)

- C is the amount of the consideration for the supply that was not paid before the end of the relevant period.

Attribution of payments for the purposes of Articles 36A and 54

(1) Where:

- a supplier makes more than one supply to a purchaser, and

- the purchaser makes a payment in relation to those supplies,

the payment must be attributed to each supply in accordance with this paragraph.

(2) The payment must be attributed to the supply which is earliest in time, and any balance must then be attributed to the supply which is next earliest in time, and so on.

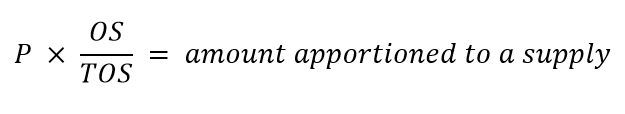

(3) If there is more than one supply, on one day, to which a payment or balance of payment could be attributed, the payment or balance of payment is attributed to each of those supplies by applying the following calculation:

Where:

- P is the payment or balance of payment made

- OS is the outstanding amount due for the supply

- TOS is the total outstanding consideration for all the supplies made on the same day.

(4) This paragraph does not apply to a payment if, at the time it is made, the purchaser allocates it to a particular supply and the payment is of the full amount due for that supply.

Attribution of payments for the purposes of Articles 36A and 54: Hire Purchase and similar agreements

(1) Where:

- a supplier made a supply of goods and, in connection with the supply, a supply of credit,

- those supplies were made under a hire purchase, conditional sale or credit sale agreement, and

- the supplier receives a payment in relation to those supplies and the payment includes an amount upon which interest is charged,

the payment must be attributed in accordance with this paragraph.

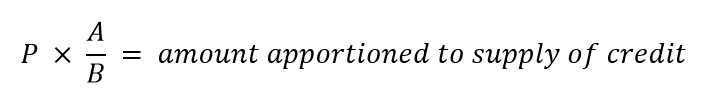

(2) An amount of the payment is attributed to the supply of credit by applying the following calculation:

Where:

- P is the payment made

- A is total of the interest on the credit provided under the agreement under which the supplies are made (determined as at the date the agreement was made)

- B is the total amount payable under the agreement, less any amount on which interest is not charged.

(3) The balance of the payment is attributed to the supply of goods.

Right to make future amendments

This Direction shall have effect from 1 January 2013. The Comptroller of Taxes reserves the right to amend or withdraw, without prior notice, any terms contained in this Direction.