Ways to contact us

If you need to contact Revenue Jersey you can use our online enquiry form, phone or call into the Tax Helpdesk during working hours, or write to us if you can't use online services.

Personal tax enquiry form

You'll get a response to your request within 5 working days.

Tell us about the following:

- change of pay or changing your hours to get a new ITIS rate

- starting or returning to work to get a new ITIS rate

- changing your employer or getting an extra job to get a new ITIS rate

- request a refund

- request a reduction in your ITIS rate (appeal due to hardship)

- register for tax to get a Tax Identification Number (TIN) and an ITIS rate

- marriage, civil partnership and separation

- birth of a child outside of Jersey

- redundancy

- retirement

- request a statement

- a mistake on your tax return

- request a penalty is waived or cancelled

Tax calculator

Get an idea of how much tax you'll pay and what allowances you'll receive.

Tax calculator

Personal tax return

If you have a digital ID and a onegov account you can file your personal tax return online. If you don't file online you'll get a paper tax return.

Accessing services online

File your tax return online

Corporate tax return

Corporate tax returns can only be filed online. You need to register for corporate online tax services. You don't need a digital ID or onegov account.

Corporate tax return online filing

Employer returns

You can register and file your combined employer returns online, which includes tax, social security and manpower returns. You need to register for employer online services. You don't need a digital ID or onegov account.

Employer returns online

GST

You can register your business for GST.

GST registration

You can submit your business GST return.

Submit your GST return

You can pay your domestic GST.

Paying GST

Paying import GST

If you are paying GST for goods you have imported you need to use the 'pay your GST and customs duties' form.

Update your ITIS rate or get a copy of your current rate

Tell us you're starting work for the first time, update your circumstances (change of earnings, additional jobs) or just request an extra copy of your ITIS rate.

Tax effective rate request

Moving address

You can use your digital ID to log into your one.gov account and update your contact details online.

Update your contact details online

If you don't have digital ID you can change your contact details with customer and local services.

Update your contact details by contacting Employment, Social Security and Housing

Register for tax and get a tax identification number

If you're new to the island you need to register as a Jersey resident. Your details are shared with Social Security, Revenue Jersey, Population office and Health and Social Services Department.

Register as a Jersey resident

If you just need to register for tax, for example you're already living in Jersey and need an ITIS rate you can update us with your circumstances.

Personal tax enquiry form

Non-residents

If you're a non-resident with taxable Jersey income you need to call us or write in with your details.

Make a voluntary disclosure

If you want to put your taxes right you can make a voluntary disclosure using our online form, but please read the voluntary disclosure information first. You can also make a voluntary disclosure on behalf of another person.

Voluntary disclosure help

Register your marriage or civil partnership with Revenue Jersey

When you marry or enter into a civil partnership you need to tell us.

Registering your marriage or civil partnership with Revenue Jersey

Permanent separation

If you permanently separate from your spouse or civil partner you will need to let us know.

Tell Revenue Jersey about a separation from your spouse or civil partner

Leaving Jersey

If you are leaving Jersey permanently or going travelling for more than 3 months you need to tell us.

Leaving the Island for more than 3 months

Tax return questions answered

Personal tax return filing

You're required to file a personal tax return if you live in Jersey and have income that is more than the

single tax threshold for the year, or you receive a tax return to complete from Revenue Jersey.

You should also file a personal tax return, even if your income is below the tax threshold if you're:

- a self-employed trader

- in receipt of income from property

- a partner in a business partnership

- a company director

Register for tax

Non-resident tax return filing

You're required to file a non-resident tax return if you don't live in Jersey but have a source of Jersey income that you need to declare and pay tax on, for example you're a non-resident landlord renting a Jersey property. The non-resident return can only be filed on a paper return.

Tax on your Jersey income if you live abroad

Partnership tax

You're required to file an online notification for the partnership if you're the precedent partner in a general partnership.

Partnership information

Corporate tax return

You're required to file a corporate return for any company, foundation, unincorporated body, association or co-operative that's managed and controlled in Jersey.

Corporate return filing

Seasonal employees

If you are working in Jersey on a seasonal basis, you'll pay tax on your Jersey income and get an allowance depending how many days you are in Jersey during the year.

Seasonal workers information

Students

If you're a full time Jersey student you will get the full tax allowance even when you are in overseas full time education.

Students tax and social security contributions

Benefits in kind

A benefit in kind (also known as employee benefits) is anything that is not money but is provided free or below the normal cost by your employer. Examples include:

- free or discounted accommodation

- a car provided by the employer

- discounted shares (share options)

Your employer should tell you what the taxable value of any benefit is so you can declare it correctly on your tax return.

About benefits in kind

ITIS effective rate tax questions answered

My tax rate has changed during the year

If you pay your tax by ITIS you are sent a provisional tax rate based on your last tax assessment. This is sent before the start of the year that it applies from. The aim of this rate is to pay your tax by the end of the year.

This is then reviewed when we calculate your tax from the information you provide on your tax return. If you haven't paid enough or you've been paying too much we'll adjust your rate to try and ensure your tax is paid.

If your income has changed and the rate will either significantly under or over pay your tax you can update your circumstances using our online form.

Update your ITIS rate

I've just received my ITIS rate for next year and it's gone up

This is your provisional ITIS effective rate and is based on your last tax assessment. It won't take into account your most current circumstances as it's just a percentage calculation of your total income and your combined tax and long-term care. The percentage is then rounded up to the nearest whole percent.

This provisional ITIS rate is then reviewed after we receive your tax return and have calculated your tax. You'll then receive your tax assessment and a reviewed ITIS rate.

If you need your rate reviewed you should file your return as early as possible or tell us about a change in your income using the online form.

More information about calculating your ITIS rate

My income has changed and I need to update my ITIS rate

You can tell us about changes in your circumstances using an online form.

Update your ITIS rate

Tax assessment questions answered

How the tax bill is calculated

The standard rate of tax in Jersey is 20%. This is the maximum personal income tax you will pay in a year. Depending on your income or your circumstances you may pay less than the standard rate.

Calculating your annual tax bill

Tax calculator

What tax deductions are available

There are various deductions and allowances which can reduce your bill. Some of these are calculated automatically (the basic allowance) and others you have to claim on your tax return to get a deduction, for example allowances for dependant children or payments you make into a pension plan.

Allowances, reliefs and deductions for income tax

Tax overpayments

If you've overpaid your tax you can either let the overpayment roll forward to next year or you can request a repayment by using the

personal tax enquiry form.

Prior year tax reform questions answered

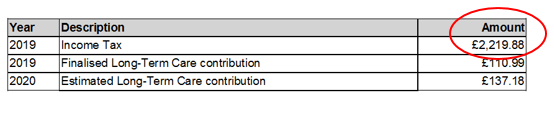

Checking your 2019 tax amount

Your 2019 tax liability is stated on your 2019 notice of tax assessment.

Moving from a prior year to a current year payment of tax

If you were a prior year taxpayer, any payments that you made for 2019 tax in 2020 were moved from 2019 tax to 2020 tax as part of the prior year tax reform in 2020.

Your 2019 tax was then frozen for payment at a future date.

The payment options

The regulations were debated by the States Assembly in March 2021.

Paying your 'prior year' 2019 tax

If you want an idea of how much your regular payments would be you can use our

2019 tax repayment calculator.